If you’re concerned about insurance premiums getting more expensive, you are not alone. Inflation has affected the prices of nearly every good and service on the market, and insurance costs are no exception.

However, in addition to inflation, there’s another significant factor at play: the hard market.

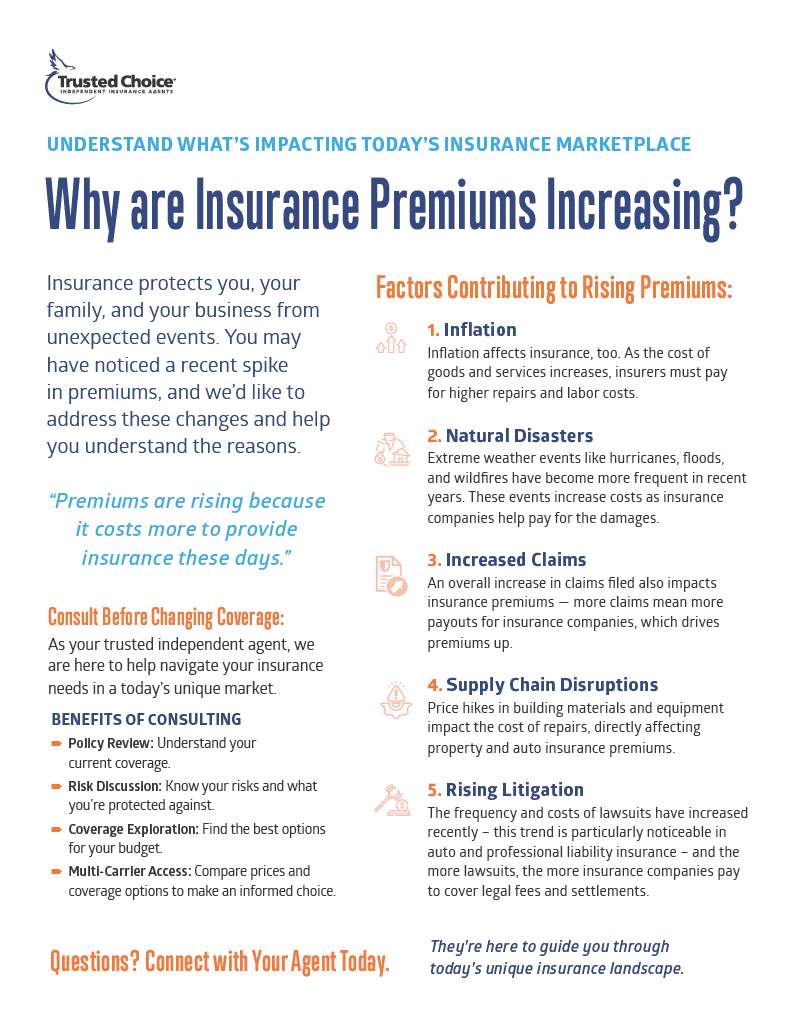

Why are Insurance Premiums Rising?

Several factors are at play, including:

- Inflation: The overall rise in the cost of goods and services directly impacts insurance costs. As the cost of repairing or replacing damaged property (cars, homes, etc.) increases, so does the amount insurers need to pay out for claims.

- More frequent and severe natural disasters: From hurricanes to wildfires, extreme weather events cause significant damage, leading to higher insurance payouts and ultimately, higher premiums for everyone.

- Increased claims overall: Regardless of the cause, more claims filed means more expenses for insurers, which translates to higher premiums down the line.

- Supply chain issues: Disruptions in the supply chain have driven up the prices of building materials and equipment, making repairs more expensive and impacting insurance costs.

- Litigation trends: The rise of lawsuits, especially in areas like auto and professional liability insurance, means insurers pay more in legal fees and settlements, leading to premium increases.

What’s a “Hard Market”?

On top of inflation, there’s another factor impacting insurance availability and cost: the hard market.

Here’s what it means:

- Higher rates: Insurance companies raise premiums to cover increased costs and maintain profitability, impacting overall market conditions and rates across the board, not just your individual situation.

- Reduced capacity: Insurers become more selective about who they insure, making it harder to obtain coverage in some areas or for certain risks.

- Reinsurance costs: Insurers also purchase reinsurance to manage risk, and those costs have also increased.

Remember:

- Your specific risk: Your location, and other factors can influence your premium more during a hard market.

How Does This Impact You?

- Limited Options: During a hard market, insurance companies tend to enforce stricter rules about what kind of risks they will insure. This generally means fewer insurance companies are competing for new customers, as they’re working hard to make sure they can protect the customers they already have. In some cases, it could be more difficult to find affordable coverage.

- Stricter Inspections: Insurance companies are more cautious when taking on customers in a hard market. This often translates to stricter home inspections, which could uncover previously unknown issues that could lead to coverage limitations or even denial.

- Premium Increases: Inflation and supply chain issues have increased the cost of labor and materials needed to repair or replace damaged vehicles and homes. To keep pace with these rising costs, insurers need to adjust coverage limits and premiums accordingly.

- Potential for Underinsurance: If your coverage limits haven’t been adjusted to reflect the increased value of your home or car, you risk being underinsured in the event of a claim.

Frequently Asked Questions

1. Why are my premiums going up even though I haven’t had any claims?

While your individual claims history is a factor, insurance premiums are primarily driven by broader market trends and increased costs for insurers. As explained earlier, the industry is currently experiencing a “hard market” with higher overall claims costs due to factors like inflation, supply chain issues, and more frequent natural disasters.

To keep up with these rising expenses and maintain profitability, insurers must raise premiums across the board, regardless of individual claim histories.

2. How long will this hard market last?

Predicting the duration of a hard market is difficult, as it’s influenced by various factors like the economy, inflation, and the types of insurance affected.

However, hard markets are cyclical, and premiums typically rise until they attract more capital back into the market, leading to a “softening” with increased competition and potentially lower premiums.

Communicating with Your Agent

Navigating a hard market can be challenging, especially with the added pressure of rising costs. However, remember you’re not alone. Open communication with your insurance agent is crucial during a hard market.

By maintaining an open dialogue with your agent and being proactive in understanding the factors driving premium increases, you can make informed decisions to protect your assets effectively during this market cycle.

For helpful tips on other popular topics, check out:

- Understanding Your Home Insurance Declaration Page

- Insuring Your Home: Replacement Cost vs. Market Value

- Personal Injury Protection & Qualified Health Letters

Article By: Karly Smith